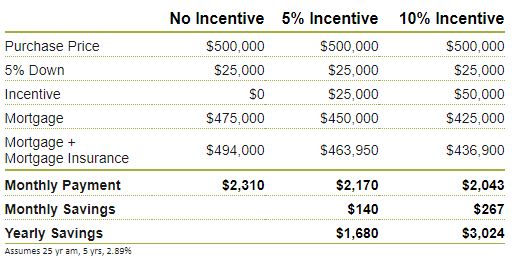

The first-time buyer incentive, launching on September 2nd. This incentive is a shared equity program designed to reduce mortgage payments for qualifying first-time buyers who have the minimum 5% down payment required for an insured mortgage. The Canada Mortgage and Housing Corporation (CMHC) will provide 5% of the cost of an existing home, or 10% of a new home. This incentive isn’t payable until you sell the property and is not charged interest.

Mortgage Payments – CMHC’s First-Time Buyer Incentive

There are a few caveats.

If your household income is more than $120,000, you aren’t eligible for the program. And your total borrowed amount (including the incentive portion) can’t be more than four times your household income. With a household income of $120,000, the maximum purchase price would be approximately $505,000 with 5% down, and about $565,000 for a 15% down payment.

You are required to pay the incentive back after 25 years or when you sell the home, with the repayment amount based on the property’s fair market value, whether it has increased or decreased in value. If you received a 5% incentive and your $500,000 home increases in value to $600,000, then you are required to repay $30,000. If the value deceases to $450,000, you’ll repay $22,500. You can repay the incentive at any time without penalty.

This new incentive program has certainly added another layer of complexity to the already complicated mortgage world. Getting expert advice throughout your mortgage years is more important than ever.

Got a home buying dream?

Feel free to get in touch for a review of your situation at any time! I can certainly run some numbers to determine if this is something you, or someone you know, may want to consider.

KELLY WILSON, AMP

Mortgage Agent

613.440.0134