The lowdown on the First-Time Buyer Incentive

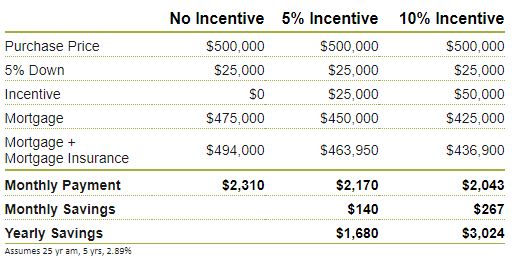

The first-time buyer incentive, launching on September 2nd. This incentive is a shared equity program designed to reduce mortgage payments for qualifying first-time buyers who have the minimum 5% down payment required for an insured mortgage. The Canada Mortgage and Housing Corporation (CMHC) will provide 5% of the cost of an existing home, or 10% of a new home. This incentive isn’t payable until you sell the property and is not charged interest.

Mortgage Payments – CMHC’s First-Time Buyer Incentive

There are a few caveats.

If your household income is more than $120,000, you aren’t eligible for the program. And your total borrowed amount (including the incentive portion) can’t be more than four times your household income. With a household income of $120,000, the maximum purchase price would be approximately $505,000 with 5% down, and about $565,000 for a 15% down payment.

You are required to pay the incentive back after 25 years or when you sell the home, with the repayment amount based on the property’s fair market value, whether it has increased or decreased in value. If you received a 5% incentive and your $500,000 home increases in value to $600,000, then you are required to repay $30,000. If the value deceases to $450,000, you’ll repay $22,500. You can repay the incentive at any time without penalty.

This new incentive program has certainly added another layer of complexity to the already complicated mortgage world. Getting expert advice throughout your mortgage years is more important than ever.

Got a home buying dream?

Feel free to get in touch for a review of your situation at any time! I can certainly run some numbers to determine if this is something you, or someone you know, may want to consider.

KELLY WILSON, AMP

Mortgage Agent

613.440.0134

BoC should begin slowing down on its rate hikes – analyst

by Ephraim Vecina 05 Nov 2018 MBN

With employment data seeing respectable and consistent gains across the board, the Canadian economy has entered a stage where additional interest rate hikes may come less frequently, according to CIBC Capital Markets chief economist Avery Shenfeld.

In its latest trade numbers release late last week, Statistics Canada said that while slightly lower wage growth and export strength also featured in the bureau’s latest report (covering September), the Bank of Canada should not view this as sufficient cause for yet another rate increase.

“On balance, this isn’t the kind of data the BoC will need to advance a rate hike into December,” Shenfeld explained in an investor note, as quoted by Bloomberg. “But there’s still another jobs report due before that decision date.”

Canada Mortgage and Housing Corporation’s former chair Robert Kelly believes that rising interest rates will be manageable even for beleaguered households, as long as these hikes remain “marginal”.

“I personally don’t think there will be a lot of impact in terms of housing prices as rates slowly edge up,” Kelly said in an interview. “The only real issue will occur in the next downturn when people realize how much debt they’ve taken on.”

Read more: BoC doublespeak on rate hikes muddies the waters – DLC’s Cooper

The debt spree that Canada has enjoyed in the last few years of record-low rates might prove to be yet another burden on households should the economy become more sluggish than anticipated, Kelly warned.

“Canadians, historically, were debt-averse. That’s no longer the case,” Kelly stated “My key ratio that I look at is personal debt-to-disposable income. In the year 2000 it was about 100%. Now it’s getting closer to 170%.”

“That 170% cent is now the highest of the G7. So, that implies [that] the next downturn could be a little tougher on housing than in other major industrialized countries.”

Which mortgage features are the most important?

Which mortgage features are the most important?

It’s easy to look online for a mortgage rate. But rate is only one aspect of saving money on your mortgage over the long term. It’s essential that you also consider mortgage features. Here are the big ones –

Early Payout Penalties. There are lots of reasons why it makes good financial sense to break your mortgage, even though you can expect to pay a penalty. But not all lenders calculate penalties the same way, and the differences can amount to thousands. Life happens, so make sure you choose a lender that has a fair prepayment penalty. And watch out for no-frill mortgages that don’t let you get out of your mortgage at all, unless you sell or the term is up.

Pre-Payment Privileges. You want the ability to put lump sum amounts on your mortgage and increase your payments so you can pay down your mortgage faster and save on interest. You should always consider having this flexibility even if you don’t think you’ll use it; your situation may change that gives you the ability to pre-pay. This flexibility can also help you reduce an early payout penalty.

Collateral charge mortgage. This type of mortgage can be difficult to transfer to another lender and cost you legal fees if you do. You are more locked in, which means your lender may not offer you the best rates if you need to refinance or at renewal. Watch out!

Porting Flexibility. This is important if there is a chance you’ll move i.e. job change, growing family. You’ll want to take your mortgage to your new place to avoid penalties. But make sure your lender lets you increase too should you buy a more expensive home.

Blended Mortgage. If you move or refinance, a blended mortgage allows you to blend the rate of your current mortgage with the rate on the additional funds. This way, you don’t break your current mortgage and incur the penalty. Some lenders blend and extend to a new 5 year term, others blend only to the remaining term, or offer both.

There is definitely more to getting a mortgage than just rate. It’s my job to help you find the right mortgage with the rate and flexibility you need to be a happy homeowner.