FIRST-TIME HOME BUYER INCENTIVE

The First-Time Home Buyer Incentive helps qualified first-time homebuyers reduce their monthly mortgage carrying costs without adding to their financial burdens.

FIRST-TIME HOME BUYER INCENTIVE

The First-Time Home Buyer Incentive helps qualified first-time homebuyers reduce their monthly mortgage carrying costs without adding to their financial burdens.

HOW THE GOVERNMENT OF CANADA INCENTIVES WORKS FOR FIRST-TIME HOME BUYERS

Learn About the Program

Calculate your maximum purchase price and what you could receive as an incentive.

- Review the program details.

- Start looking for a home.

Determine Your Eligibility

- Contact a lender/mortgage professional

- Review program requirements and ensure that this is for you.

- Try the self-assessment tool.

Choose Your Incentive and Apply

- Review the details and select the incentive that is right for you.

- Read, print and sign the application documents in the resources section and take them to your lender.

- Application submissions will be completed by your lender.

- Notify your solicitor.

- Call the 1-800 number to activate (see “How do I apply?”).

Repayment

- Early payout options in full are available at any point in the duration of the 25 years.

- Learn more about fair market value and how this will help you calculate repayment.

- Calculate the fair market value of your home and multiply it by the percentage of the Incentive you received.

ABOUT THE FIRST-TIME HOME BUYER INCENTIVE

There are a few qualifiers to apply for this incentive:

you need to have the minimum down payment to be eligible

your maximum qualifying income is no more than $120,000

your total borrowing is limited to 4 times the qualifying income

If you meet these criteria, you can then apply for a 5% or 10% shared equity mortgage with the Government of Canada. A shared equity mortgage is where the government shares in the upside and downside of the property value.

HOW DOES IT WORK?

The incentive enables first-time home buyers to reduce their monthly mortgage payment without increasing their down payment. The Incentive is not interest bearing and does not require ongoing repayments.

If you meet these criteria, you can then apply for a 5% or 10% shared equity mortgage...

You have to repay the Incentive after 25 years or if the property is sold, whichever happens first.

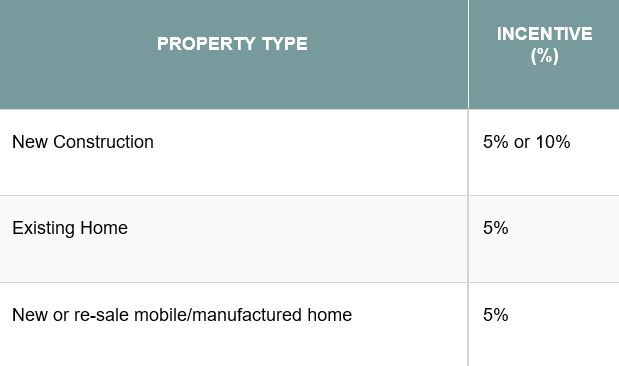

THROUGH THE FIRST-TIME HOME BUYER INCENTIVE, THE GOVERNMENT OF CANADA WILL OFFER:

5% for a first-time buyer’s purchase of a re-sale home

5% or 10% for a first-time buyer’s purchase of a new construction

HOW DO I KNOW HOW MUCH I HAVE TO PAY BACK?

You can repay the Incentive at any time in full without a pre-payment penalty. You have to repay the Incentive after 25 years or if the property is sold, whichever happens first. The repayment of the Incentive is based on the property’s fair market value.

You receive a 5% incentive of the home’s purchase price of $200,000, or $10,000.

If your home value increases to $300,000 your payback would be 5% of the current value or $15,000.

You receive a 10% incentive of the home’s purchase price of $200,000, or $20,000 and your home value decreases to $150,000, your repayment value will be 10% of the current value or $15,000.

NOTE: If your property value goes down, you are still responsible for repaying the shared equity mortgage based on the current home value at time of repayment.

HOW DO I APPLY?

Complete and sign the application documents in the resources section and take them to your lender, who will submit them on your behalf.

NOTE: Once processed and accepted, you MUST call 1.833.974.0963 to activate the FTHBI payment and provide the name of the lawyer/notary you have chosen to close your deal. You must provide your lawyer/notary information as soon as you have chosen one and no less than 2 weeks prior to your closing.

If approved for the Incentive, the purchase transaction must close on or after November 1, 2019.

How much funding is available?

The total amount of funding will be $1.25 billion over 3 years.

WHY USE THE FIRST-TIME HOME BUYER INCENTIVE?

Why is it for first-time homebuyers only?

For many Canadians, especially young people and first-time buyers, finding an affordable place to call home is not just a challenge – it feels like an impossibility. There aren’t enough houses for people to buy, or apartments for people to rent. That makes finding a good place to live too expensive and beyond what many people, especially younger Canadians, can afford.

This initiative is designed to help young Canadians access home ownership in a fiscally responsible and affordable way. Statistically this is the demographic group with the lowest percentage of homeownership.

This initiative is designed to help young Canadians access home ownership in a fiscally responsible and affordable way.

By obtaining the Incentive, the borrower may not have to save as much of a down payment...

HOW WILL THIS HELP YOUNGER CANADIANS STRUGGLING TO SAVE FOR A DOWN PAYMENT?

In all cases, the borrower must meet minimum down payment requirements with traditional sources such as savings, withdrawal/collapse of a Registered Retirement Savings Plan (RRSP), or a non-repayable financial gift from a relative/immediate family member. By obtaining the Incentive, the borrower may not have to save as much of a down payment to be able to afford the payments associated with the mortgage.

WHAT KIND OF PROPERTY CAN I PURCHASE?

What properties are eligible?

The Incentive is to help first-time homebuyers purchase their first home.

Eligible residential properties include:

- new construction

- re-sale home

- new and re-sale mobile/manufactured homes

- Residential properties can include 1 to 4 units

Types of residential properties include:

- single family homes

- semi-detached homes

- duplex

- triplex

- fourplex

- town houses

- condominium units

IMPORTANT: The property must be located in Canada and must be suitable and available for full-time, year-round occupancy.

QUALIFY FOR A HOME EQUITY LINE OF CREDIT

You only have to qualify and be approved for a home equity line of credit once. After you’re approved, you can access your home equity line of credit whenever you want.

You’ll need:

- a minimum down payment or equity of 20%, or

- a minimum down payment or equity of 35% if you want to use a stand-

- alone home equity line of credit as a substitute for a mortgage

Before approving you for a home equity line of credit, your lender will also require that you have:

- an acceptable credit score

- proof of sufficient and stable income

- an acceptable level of debt compared to your income

To qualify for a home equity line of credit at a bank, you will need to pass a “stress test”. You will need to prove you can afford payments at a qualifying interest rate which is typically higher than the actual rate in your contract.

Are mobile/manufactured homes eligible for the FTHBI program?

Yes, new or re-sale mobile homes are eligible for a maximum Incentive of 5%. Mobile/manufactured homes will be eligible for the Incentive where the unit is situated on either owned or leased land.

To qualify for a home equity line of credit at a bank, you will need to pass a “stress test”.

Can I buy a house using the program and rent it out?

No. The incentive is to help first-time homebuyers purchase their first home with the intent to occupy the property. Investment properties are not eligible.

There may be an exception for situations of hardship.

IMPORTANT: The property must be located in Canada and must be suitable and available for full-time, year-round occupancy.

Mobile/manufactured homes will be eligible for the Incentive where the unit is situated on either owned or leased land.

Are mobile/manufactured homes eligible for the FTHBI program?

Yes, new or re-sale mobile homes are eligible for a maximum Incentive of 5%. Mobile/manufactured homes will be eligible for the Incentive where the unit is situated on either owned or leased land.

Can I buy a house using the program and rent it out?

No. The incentive is to help first-time homebuyers purchase their first home with the intent to occupy the property. Investment properties are not eligible.

There may be an exception for situations of hardship.

FREQUENTLY ASKED QUESTIONS

The Program Administrator does not need to be notified prior to a homeowner completing renovations on their home. It is recommended however that the homeowner consider the cost and benefits of the planned renovations, as the Government of Canada will share in any appreciation of the market value at the time of Incentive repayment.

Who can apply?

Canadian citizens, permanent residents, and non-permanent residents who are legally authorized to work in Canada

Borrowers must have a maximum qualifying income of $120,000

Total qualifying income must be $120,000 per year or less

This is subject to qualifying income requirements set out by lenders and mortgage loan insurers

At least one borrower must be a first-time homebuyer, as per the definition below.

To be eligible for the FTHBI the combined qualifying income on your application cannot be higher than $120,000. That means whether you are applying by yourself, with a friend or a spouse you have to add your qualifying income and make sure it is less than $120,000.

Here are a few examples of qualifying income:

- annual salary (before taxes)

- investment income

- rental income

You are considered a first-time homebuyer if you meet one of following qualifications:

- you have never purchased a home before

- you have gone through a breakdown of a marriage or common-law partnership (even if you don’t meet the other first-time home buyer requirements).

- in the last 4 years, you did not occupy a home that you or your current spouse or common-law partner owned

IMPORTANT: It’s possible that you or your spouse or common-law partner qualifies for the First-Time Home Buyer Incentive (if you are in a married or common-law relationship) with the 4-year clause even if you’ve owned a home.

The 4-year period begins on January 1 of the fourth year before the Incentive is funded and ends 31 days before the date the Incentive is funded. For example, if the Incentive will be funded on November 1, 2019, the four-year period begins on January 1, 2015 and ends on September 30, 2019.

What are the mortgage details?

Total borrowing is limited to 4 times the qualifying income. The combined mortgage and Incentive amount cannot exceed four times the total qualifying income. The amount for the mortgage loan insurance premium is excluded from this calculation.

The maximum threshold for debt service ratios are GDS 39% and TDS 44%. This is only applied on the first mortgage and is subject to requirements by lenders and mortgage loan insurers.

The Incentive is a second mortgage on the title of the property. There are no regular principal payments. It isn’t interest bearing and has a maximum term of 25 years.

The Government of Canada will share in the upside and downside of the property value upon repayment.

Mortgages must be eligible for mortgage loan insurance through either Canada Guaranty, CMHC or Genworth. The first mortgage must be greater than 80% of the value of the property and is subject to a mortgage loan insurance premium.

The premium is based on the loan-to-value ratio of the first mortgage only. That is, the first mortgage amount divided by the purchase price. The Incentive amount is included with the total down payment.

Mortgage loan insurance premiums may vary depending on the mortgage loan insurer and may be subject to provincial taxes.

It’s an insurance that protects a lender against default on a mortgage. Mortgage loan insurance is required for any mortgage where the down payment is less than 20% of the purchase price or market value of a home. As for the FTHBI, mortgages must be eligible for mortgage loan insurance through one of Canada’s 3 authorized Mortgage Loan Insurance providers, namely, Canada Guaranty, CMHC or Genworth.

Minimum down payment is 5% of the first $500,000 of the lending value and 10% of the lending value above $500,000.

The minimum down payment must come from traditional down payment sources.

Note: Unsecured personal loans or unsecured lines of credit used to satisfy minimum down payment requirements are not eligible for the program.

Note: For 3-4 units properties, the minimum down payment is 10%.

Traditional down payment comes from the borrower’s own resources and may include:

- savings

- withdrawal/collapse of a registered retirement savings plan (RRSP)

- non-repayable financial gift from a relative

The date when the sale of the property becomes final, title to the property is registered, purchase funds are exchanged, and the new owner has the legal right to take possession of the home.

Yes, the first mortgage may be switched to a different financial institution without having to repay the Shared Equity Mortgage Loan (‘the Incentive’). The terms of the first mortgage may not be altered in this case. In some instances, there may be additional legal fees associated with switching your first mortgage when you have a shared equity mortgage registered against your property.

If I decide to purchase a new property, can I port (moving the mortgage to a new property) the Incentive along with my first mortgage?

A Port under the FTHBI program will be considered a sale which will require repayment of the Incentive.

Yes, the first mortgage may be switched to a different financial institution without having to repay the Shared Equity Mortgage Loan (‘the Incentive’). The terms of the first mortgage may not be altered in this case. In some instances, there may be additional legal fees associated with switching your first mortgage when you have a shared equity mortgage registered against your property.

If I decide to purchase a new property, can I port (moving the mortgage to a new property) the Incentive along with my first mortgage?

A Port under the FTHBI program will be considered a sale which will require repayment of the Incentive.

If a homebuyer receives a 5% Incentive, the homebuyer will repay 5% of the home’s value at repayment.

If a homebuyer receives a 10% Incentive, the homebuyer will repay 10% of the home’s value at repayment.

Repayment is based on the property’s fair market value at the point in time where repayment is required.

What if I am unable to pay back both my first mortgage and the Incentive when I sell my property?

The Program Administrator will work with borrowers who are experiencing financial hardship on a case-by-case basis to offer solutions to the repayment requirements.

The Incentive may be associated with additional costs:

- Additional legal fees: Your lawyer is closing 2 mortgages so you may be charged higher fees.

- Appraisal fees: To repay your incentive, you may need to have an appraisal done to value determine the fair market value of your home.

- Other fees: Additional fees may be incurred throughout the life cycle of the incentive, like switching your first mortgage to a new lender or refinancing your first mortgage.

Yes, the first mortgage may be switched to a different financial institution without having to repay the Shared Equity Mortgage Loan (‘the Incentive’). The terms of the first mortgage may not be altered in this case. In some instances, there may be additional legal fees associated with switching your first mortgage when you have a shared equity mortgage registered against your property.

If I decide to purchase a new property, can I port (moving the mortgage to a new property) the Incentive along with my first mortgage?

A Port under the FTHBI program will be considered a sale which will require repayment of the Incentive.

Let’s look at a specific situation:

Anita wants to buy a new home for $400,000 and has saved the minimum required down payment of $20,000 (5% of the purchase price).

Under the First-Time Home Buyer Incentive, Anita can apply to receive $40,000 in a shared equity mortgage (10% of the cost of a new home) through the program.

This lowers the amount Anita needs to borrow and reduces the monthly expenses.

As a result, Anita’s mortgage is $228 less a month or $2,736 a year.

Ten years later, Anita sells the home for $420,000. The Incentive will need to be repaid as a percentage of the home’s current value.

This would result in Anita repaying 10%, or $42,000 at the time of selling the house.

Source: https://www.placetocallhome.ca Government of Canada

For more detailed information contact the Wilson Team at 1-855-695-9250