Federal Government Makes it Easier for Middle Class Canadians to Buy their First Home

NEWS PROVIDED BY Canada Mortgage and Housing Corporation

MONTREAL, July 5, 2019 /CNW/ - All Canadians deserve to have a safe and affordable place to call home. That is why the Government of Canada is introducing an innovative new tool to help middle class Canadians buy their first home.

Today, the Honourable Jean-Yves Duclos, Minister of Families, Children and Social Development and Minister Responsible for Canada Mortgage and Housing Corporation (CMHC), announced the details of the First-Time Home Buyer Incentive, including the expected launch date.

Starting on September 2, 2019, the First-Time Home Buyer Incentive will help middle class families take their first steps towards homeownership by reducing monthly mortgage payments required for first-time homebuyers without increasing the amount they need to save for a downpayment. This program complements other measures taken in Budget 2019 to support first time homebuyers with their downpayment such as increased RRSP withdrawal limit from $25,000 to $35,000. The Government of Canada has allocated $1.25 billion over three years (starting in 2019) for this program. The incentive will be available to first-time homebuyers with qualified annual household incomes up to $120,000.

Budget 2019 also previewed the Shared Equity Mortgage Provider Fund, a five-year, $100-million lending fund to assist providers of shared equity mortgages to help eligible Canadians achieve affordable homeownership. This will support an alternative homeownership model targeted at first-time homebuyers, help attract new providers of shared equity mortgages and encourage additional housing supply. The fund will be launched on July 31st, 2019, and will be administered by CMHC.

Quotes

"Through the National Housing Strategy, more middle-class Canadians - and people working hard to join it - will find safe, accessible and affordable homes. Our proposed measures will reduce the monthly mortgage for your first home by up to $286. This will mean more money in the pockets of Canadians and will help up to an estimated 100,000 families across Canada." – Jean-Yves Duclos, Minister of Families, Children and Social Development and Minister Responsible for Canada Mortgage and Housing Corporation

Quick Facts about the First Time Homebuyer Incentive

- Canada's First-Time Home Buyer Incentive will help qualified first-time home buyers purchase their first home as the incentive reduces their monthly mortgage payment, without increasing the amount that they must save for a down payment. The program will launch on September 2, 2019, with the first closing on November 1, 2019.

- The incentive will allow eligible first-time home buyers who have the minimum down payment for an insured mortgage with CMHC, Genworth or Canada Guaranty, to apply to finance a portion of their home purchase through a form of shared equity mortgage with the Government of Canada.

- For the purchase of an existing home, an incentive amount of 5 percent may be available. For the purchase of a newly constructed home, an incentive amount of 5 percent or 10 percent may be available.

- Doubling the incentive for purchasers of new homes encourages new housing supply.

- No on-going repayments are required, the incentive is not interest bearing, and the borrower can repay the incentive at any time without a pre-payment penalty.

- The government shares in the upside and downside of the change in the property value.

- The buyer must repay the incentive after 25 years, or if the property is sold.

- The incentive will be available to first-time homebuyers with qualified annual household incomes up to $120,000. At the same time, a participant's insured mortgage and the incentive amount cannot be greater than four times the participant's qualified annual household income.

- Per the table below, for a family buying a $500,000 home, this program could save them as much as $286 per month or more than $3,430 a year (note: for illustration purposes only, results subject to change depending upon amortization, interest rate, term, etc.).

Quick Facts about the Shared Equity Mortgage Provider fund program

- The Shared Equity Mortgage Provider (SEMP) fund program will assist providers of shared equity mortgages in helping eligible Canadians achieve affordable homeownership.

- The SEMP fund program is a 5-year program scheduled to launch on July 31, 2019.

- This $100-million lending fund, administered by CMHC, will help attract new providers of shared equity mortgage and encourage additional housing supply.

- The program will offer eligible proponents loans from two possible funding streams: Pre-construction (stream 1) and Direct Shared Equity Mortgages (stream 2)

- Stream 1 is for pre-construction costs to commence new housing projects that provide shared equity mortgages to home purchasers.

- Stream 2 is for funding of shared equity mortgages provided by the proponent directly to home purchasers.

- Non-profit organizations, other level of governments and for-profit organizations may be eligible to apply.

- Visit here for further Shared Equity Mortgage Provider Fund program details

- The Government of Canada's National Housing Strategy (NHS) is an ambitious 10-year, $55 billion plan that will create 125,000 new housing units, repair and renew more than 300,000 housing units and reduce chronic homelessness by 50 percent, with the target of removing 530,000 families from housing need

- The NHS is built on strong partnerships between federal, provincial and territorial governments, and on continuous engagement with others, including municipalities, Indigenous governments and organizations, and the social and private sectors, to make a meaningful difference in the lives of Canadians.

Associated Links

As Canada's authority on housing, CMHC contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC's aim is that by 2030, everyone in Canada has a home they can afford, and that meets their needs. For more information, please visit cmhc.ca or follow us on Twitter, Instagram, YouTube, LinkedIn and Facebook.

To find out more about the National Housing Strategy, visit www.placetocallhome.ca.

SOURCE: Canada Mortgage and Housing Corporation

Canada’s mortgage stress tests just got a little easier

Source: MATT LUNDY PUBLISHED JULY 18, 2019

Canadian Interest Rates Has Fallen

The interest rate used in Canada’s mortgage stress tests has fallen for the first time since 2016, making it slightly easier to become a homeowner.

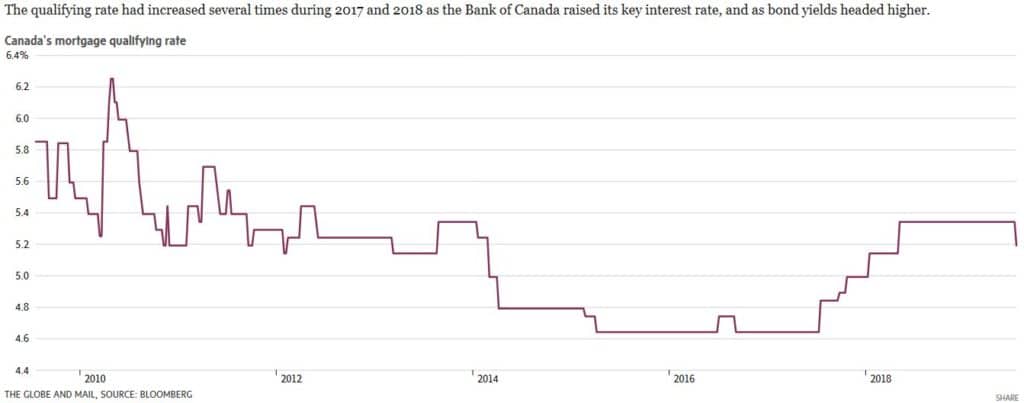

The mortgage qualifying rate dropped to 5.19 per cent from 5.34 per cent, where it had been locked since May of 2018, according to new figures from the Bank of Canada. The rate is derived from the most frequently occurring five-year, fixed posted rates at Canada’s Big Six banks. (Market rates are much lower, and some discount lenders offer five-year fixed rates as low as 2.47 per cent.)

The qualifying rate had increased several times during 2017 and 2018 as the Bank of Canada raised its key interest rate, and as bond yields headed higher.

The Stress Test

The stress tests are used to ensure homeowners and prospective buyers could continue to afford their mortgage payments at higher interest rates, and apply only to federally regulated lenders. The Department of Finance first imposed a stress test on insured buyers, or those who typically make a down payment of less than 20 per cent of the home’s purchase price, starting in the fall of 2016. Canada’s banking regulator followed suit with a similar test on uninsured buyers, which went into effect in 2018.

The second test is widely credited as one of the factors that has weighed on resale activity in Canada’s real estate market.

The new qualifying rate will have a tangible impact on a home buyer’s purchasing power. For someone making a 20-per-cent down payment, and who earns $50,000 a year, the lower rate will allow them to afford a home that is roughly $4,000 more expensive, according to calculations from RateSpy.com. For those earning $100,000 a year, with the same down payment, they can buy a home about $8,300 pricier. (RateSpy assumes no other debts and a 30-year amortization.)

Mortgage Stress Test Rules just became less stringent

Canada's Posted mortgage rates have headed lower, so stress test benchmark has followed suit

The Stress Test

Mortgage rates in Canada have steadily fallen this year, and so has the stress-test rate that lenders must qualify borrowers against. (Daniel Munoz/Reuters)

For the first time since the government implemented new stress test rules on Canadian home loans, the bar has been lowered — meaning a would-be home buyer could be approved for a bigger mortgage today than they would have yesterday.

The so-called stress test in place since January 2018, is a financial bar that any Canadian looking to take out a mortgage must pass to be approved for one. Regardless of what deals they may have been offered by a lender in the real world, for regulators to sign off on the loan, the borrower's finances must be tested as though their mortgage rate is at a higher level. The idea is to save borrowers from biting off more debt than they can chew and ensure they have some financial wiggle room if rates rise.

The stress-test level is set at either two percentage points above the actual mortgage rate or whatever the average five-year posted rate is at Canada's big banks, as calculated by the Bank of Canada — whichever is higher.

That bank rate hasn't changed since May 2018, when it rose to 5.34 per cent. But this week, it inched down to 5.19 per cent, the first time it has decreased in almost three years.

More purchasing power

The impact of the slight lowering of that bar is to let people qualify for a bigger mortgage than they could before, even if everything else in their finances has stayed the same. It has the effect of giving them slightly more purchasing power, allowing them to fish in a slightly more expensive pond full of homes.

It's not a huge move, by any stretch.

What does it actually mean to you?

Rate comparison website Ratehub.ca calculates the typical borrower can now afford about 1.4 per cent more home than they could previously. Assuming a borrower had a down payment of at least 20 per cent, no other debts to speak of, and earned $100,000 a year, under the previous test level, they would have qualified for a home valued at $589,000. Today that same family can buy a house worth $597,000.

It doesn't make their mortgage any easier to pay off. It just allows them to theoretically buy a slightly more expensive home than they would have previously been allowed to.

Samantha Brookes, CEO of broker Mortgages of Canada, says overall, the stress test has put a chill on the market, but she doubts that this week's move will make a major dent in its impact.

"It allows someone purchasing to buy a little bit more but it's not that significant," she said. "Consumers are in this wait-and-see pattern — it's still difficult to get into the market because that stress test is there."

And the tiny amount of extra wiggle room that this week's move may make the dollars and cents add up a little better on paper, but the real impact may be all in our heads, says Nick Kyprianou, president of RiverRock Mortgage Investment Corporation, a Toronto-based alternative mortgage lender.

How did the stress test affect the market

Kyprianou is somewhat of a rarity in that he makes his money in real estate, but isn't among those who blame the implementation of the stress test in 2018 for taking away the punch bowl and ending a real estate party in full swing.

He may have a bias in that the stress test made his business busier, as people shut out of traditional lenders by the new rules flocked to alternative lenders. "But it was a reasonable thing to do," he says. "As a homeowner and a citizen it wasn't the wrong decision — things were irrational."

Kyprianou says the stress testing level moving almost imperceptibly lower is likely to help the market just by instilling confidence, because it's not just the theoretical testing level that's lower — actual mortgage rates are falling too.

How is fixed mortgage rates priced?

Fixed mortgage rates are priced on what's happening in the bond market, which has been signalling for months that it expects cheaper lending rates to come.

The U.S. central bank could cut its benchmark interest rate as soon as the end of this month, and while Canada is expected to stand put for a while, the Bank of Canada is not immune to the global forces that may push rates down even lower.

As long as house prices don't crater, rates in the real world moving lower will have a much bigger impact than this week's tiny wobble in the stress test, Kyprianou says.

"This is a psychological game. If people feel confident they'll get back in the market."

Source:Pete Evans · CBC News · CBC's Journalistic Standards and Practices|About CBC News